Why Sustainable Marketing is Relational — not Transactional

Last updated on October 19th, 2022

One mistake many inexperienced entrepreneurs and managers make is to view business from a purely transactional (one-time exchange) perspective. A large part of a marketer’s job—some would argue the main part—is cultivating relationships.

Of course, relationships are a two-way street. You can’t force relationships to develop, and most of your customers will purchase with a purely transactional intent.

Why Manage Customer Relationships?

Following the Pareto principle, customers with a transactional intent will typically comprise roughly 80% of any business’s clientele. If this is the case, why bother managing customer relationships? Why cater to that other 20%?

Following the same principle, that same 20% will typically be responsible for around 80% of your sales. This Slideshare, while made from a narrower advertising perspective, illustrates why it’s important to consider interactions with customers as opportunities to develop relationships instead of as just a way to increase sales.

Keeping track of the habits of thousands, if not millions, of customers is a huge challenge, and attempting to develop long-lasting relationships systematically is even more so. However, it is worthwhile for several very good reasons.

A good Customer Relationship Management strategy will:

- Create a stable flow of income.

- Create a positive impression of your brand.

- Turn customers with otherwise negative experiences into advocates.

- Allow you to gather customer information that would be unobtainable without a CRM strategy.

- Reduce your dependence on additional manpower for external sales and promotion. New customers will come to you from outside the scope of your direct promotions.

- Increase the positive impression given via word-of-mouth. Not all word-of-mouth is good for you!

- Speed up customer decisions, allowing more to be served per unit of time. Increased trust from good CRM will reduce time spent waffling on details.

- Help you retain existing customers

- Increase opportunities for joint ventures and promotions with other highly regarded brands.

- Increase sales!

- Ultimately, reduce the cost of each sale.

- Improve long-term profitability.

What counts as transactional or relational?

This is infinitely debatable, but common answers that contrast the two include:

| Transactional |

Relational |

| professional |

friendly |

| self-interest |

mutual interest |

| understand processes |

understand people |

| win conflict |

resolve conflict |

Of course, you aren’t in business to develop relationships— you’re in business to earn a profit. A relational approach is desirable in most businesses for many reasons, but it always needs to be done with the intent of closing sales. An overly soft approach might leave you without any.

The Sales Process

The first step to a systematic, trackable CRM system is to examine your sales process. At a casual glance, a sale would seem like just an exchange of one thing of value for another. But there are actually several things going on in any transaction.

In Management of a Sales Force by Rich, Spiro and Stanton, a sale is broken down into the following steps.

- Prospecting /First contact

- Planning the sale

- Approach

- Customer needs assessment

- Presentation

- Meeting objections

- Gaining commitment

- Follow-up

Whether you believe in this model or another, more things happen in any sale than a casual observer (or a casual entrepreneur) might expect. Each step is an opportunity for any CRM system, whether for directly improving customer experience or for tracking and data analysis.

The Purchase Funnel

A Purchase funnel (also known as a Sales funnel or a Decision funnel) is any of many different models that illustrate how a customer arrives at a decision.

It doesn’t necessarily have to be a purchase. The funnel could be used to examine several customer actions, from participating in surveys to sharing promotions.

You might already have heard about the parts of a classic purchase funnel. The AIDA model, an acronym for Awareness, Interest, Desire, and Action, is one of the most popular ways to explain what happens in a sale.

provenmodels.com

The idea has been misused and misunderstood a lot as well. Some business writers may omit the inverted pyramid or funnel concept altogether. But the shape actually illustrates that “acting” (i.e., paying) customers will always represent a small fraction of the people who are actually made aware of your product or service.

Fewer people always take action than those who merely desire to act. Fewer people always desire your product than are merely interested in it. Fewer people are always interested in your product than those who are merely aware of it.

While not a perfect way of saying things, it might be useful to think of it this way: A marketer’s job would be to widen each funnel stage. Widening on top implies increasing your reach, and widening the middle or bottom implies higher conversion rates. Indeed, this pathway is often called the chain of conversion.

Customer Lifecycle Management

Speaking of the

chain of conversion, the Customer Lifecycle refers to the measurement of customer behavior as they move through that chain and subsequent interactions over time.

Customer Lifecycle Management involves controlling factors that influence customer behavior as they interact with your business, hopefully leading to positive outcomes for your business (repeat sales, better branding, etc.)

A simplified customer lifecycle is often represented as:

- Acquisition – When someone first becomes a customer.

- Service – When goods are exchanged.

- Retention – When a customer comes back for another transaction.

Customer Lifecycle Management is often confused with Customer Relationship Management or CRM. They are mostly similar, except CLM, which involves the element of time.

The Customer Buying Window

The “buying window” or “purchase window” is a period when:

- A product or service will be available in the foreseeable future.

- Customers have already decided to purchase that product/service.

- No sale or exchange has been made… yet.

This means that your customers are at the “action” stage of the purchase funnel or are at least getting there. It does not necessarily mean they have decided to buy your product. Staple items, such as office supplies, are not usually purchased based on brand as much as they are for function, cost, and availability.

As soon as the decision has been made, a marketer’s job is to make it as simple as possible for customers to get what they already want. Reduce the number of steps they must go through before making a purchase, and avoid confusing them with extraneous options.

Some things to consider:

- Customer buying windows are highly variable, ranging from a matter of moments (impulse purchases) to years (e.g., real estate, some preordered tech items). Until recently, Google Adwords measured conversions (purchases and opt-ins) using 30 days, but recently (and extremely belatedly), it has allowed customization from 7 to 90 days to reflect this wide variability.

- Different marketing channels and products motivate in different ways. For example, you are more likely to buy food when you are close enough to smell it. On the other hand, banking services typically have fewer hassles online than in the real world. You might feel less need to buy clothes distributed online than in a brick-and-mortar store.

- You control product availability. Limited time or distribution offers give customers a sense of urgency or exclusivity. These can be tied into promotions and branding. Luxury or aspirational brands, for example, benefit to some degree by not being readily available. Limiting availability can also test new products and drum up support for your brand.

- A good sales team is indispensable! Your salespeople will often have a firsthand market experience that is unquantifiable or difficult to observe otherwise. Your customers will also often develop relationships with your salespeople, not your brand. It’s crucial that your sales force understands the goals and intent of your CRM strategies, which are a part of your marketing campaign planning process.

Customer Lifetime Value

Customer lifetime value

Customer lifetime value (CLV) (or CLTV), lifetime customer value (LCV), user lifetime value (ULTV), or lifetime value (LTV) is a prediction of revenue and sometimes intangible value a customer gives throughout their relationship with a seller/provider.

Customer lifetime value should not be confused with customer profitability, which is a purely historical view without future projections.

There are several good reasons for tracking customer lifetime value:

- To determine differences between different kinds of customers

- To allow better allocation of resources according to types of customers, especially for promotions and retention programs

- To provide a better idea of how CRM programs are running

- To give an accurate idea of customer acquisition costs and how to reduce them

- It gives business managers a long-term view of customer behavior, necessary for stable growth

There are no real disadvantages at all to tracking customer lifetime value. However, it is easy to misinterpret data or use the wrong models if there is a lack of understanding of the market context.

There are several ways of calculating lifetime value. Creating accurate models for every possible combination of product, customer, and future outcomes would not be feasible.

Here are some of the more popular inputs:

- Churn rate

- Retention rate

- Discount rate

- Interest rate

- Inflation rate

- Contribution margin

- Gross Contribution

- Retention cost

- Period

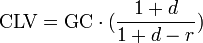

Examples of different formulas for calculating customer lifetime value:

- Where

is yearly gross contribution per customer,

is yearly gross contribution per customer,  is retention costs per customer per year,

is retention costs per customer per year,  is the horizon in years,

is the horizon in years,  is the yearly retention rate,

is the yearly retention rate,  is the yearly discount rate.

is the yearly discount rate.

One of the more popular simplified versions:

- Assume constants for contribution margin, retention rate, and discount rates.

And others:

- CLV = Margin ($) * (Retention Rate (%) ÷ [1 + Discount Rate (%) – Retention Rate (%)])

- CLV = (Average Value of a Sale) *(Number of Repeat Transactions)*(Average Retention Time in Months or Years for a Typical Customer)

- CLV = (Avg Monthly Revenue per Customer * Gross Margin per Customer) ÷ Monthly Churn Rate

- CLV = (latest month’s Average Order Value) * ( [lifetime AOV] / [AOV]) * (Gross Margin)

Why so many formulas?

Customer Lifetime Value is dynamic, and the required inputs will likely change over time. Formulas should be chosen or developed in the context of your products, environment

, and Customer Relations Management strategy. For this and many other reasons, the Marketing Accountability Standards Board does not officially endorse any method for calculating customer lifetime value.

CLV should not be the sole factor for making decisions on marketing strategy for the following reasons.

- Intangible values and differences in demographic behavior are difficult to include as inputs

- Serving only “high-value” customers might lead marketing strategists to neglect opportunities to convert other customers.

- The risk of saturating high-value customers is high (they cannot buy an infinite number of cars, donuts, etc)

- The nature of product-customer-seller relationships is often difficult, if not impossible, to predict accurately.

Why Your Approach to CRM May Be Wrong

There is much confusion about CRM’s role in businesses, given the non-standardization of terms and methods and the amount of data gathering and analysis that takes place.

Despite its extensive demands on number-crunching, Customer Relationship Management is by no means an exact science, and it is a mistake to treat it as such.

Like most marketing practices, CRM should also be seen as an art from both hard and soft science perspectives. A purely numbers-based approach has been the downfall of many attempts at CRM.

Once this is understood, it’s clear that a balanced, rational CRM strategy and prudent execution—as opposed to blindly following set processes—are needed not only for repeat business, better branding, and customer satisfaction but also for sustainable growth.

What’s your approach to Customer Relations Management?

Other parts of our Basic Marketing Concepts series!

The Marketing Mix: The 4 P’s of Marketing

Demand Generation

The Sales Process

The Purchase Funnel

Sources

- Barry, Thomas. 1987. The Development of the Hierarchy of Effects: An Historical Perspective. Current Issues and Research in Advertising, 251-295.

- A modern purchase funnel concept – Marketing-made-simple.com (2009)

- The customer decision journey – McKinsey Quarterly(2009)

- “The salesman should visualize his whole problem of developing the sales steps as the forcing by compression of a broad and general concept of facts through a funnel which produces the specific and favorable consideration of one fact. The process is continually from the general to the specific, and the visualization of the funnel has helped many salesmen lead a customer from Attention to Interest and beyond” (p. 109).

- salesboom.com/whitepapers/what_is_clm_whitepaper.pdf

- Farris, Paul W.; Neil T. Bendle; Phillip E. Pfeifer; David J. Reibstein (2010). Marketing Metrics: The Definitive Guide to Measuring Marketing Performance. Upper Saddle River, New Jersey: Pearson Education, Inc. ISBN 0137058292. The Marketing Accountability Standards Board (MASB) endorses the definitions, purposes, and constructs of classes of measures that appear inMarketing Metrics as part of its ongoing Common Language: Marketing Activities and Metrics Project.

- Shaw, R. and M. Stone (1988). Database Marketing, Gower, London.

- Peppers, D., and M. Rogers (1997). Enterprise One to One: Tools for Competing in the Interactive Age. New York: Currency Doubleday.

- Hanssens, D., and D. Parcheta (forthcoming). “Application of Customer Lifetime Value (CLV) to Fast-Moving Consumer Goods.”

- Ryals, L. (2008). Managing Customers Profitably. ISBN 978-0-470-06063-6. p.85.

- Berger, P. D. and Nasr, N. I. (1998), “Customer lifetime value: Marketing models and applications.” Journal of Interactive Marketing, 12: 17–30. doi:10.1002/(SICI)1520-6653(199824)12:1<17::AID-DIR3>3.0.CO;2-K

- Adapted from “Customer Profitability and Lifetime Value,” HBS Note 503-019.

- Gary Cokins (2009). Performance Management: Integrating Strategy Execution, Methodologies, Risk and Analytics. ISBN 978-0-470-44998-1. p. 177

- V. Kumar (2008). Customer Lifetime Value. ISBN 978-1-60198-156-1. p. 6

Image Sources

Window: The Uprooted Photographer via photopin cc

Formula: trindade.joao via photopin cc

Haggle: TheeErin via photopin cc

Service: Lynn (Gracie’s mom) via photopin cc

Quote: deeplifequotes via photopin cc

Transaction CarbonNYC via photopin cc